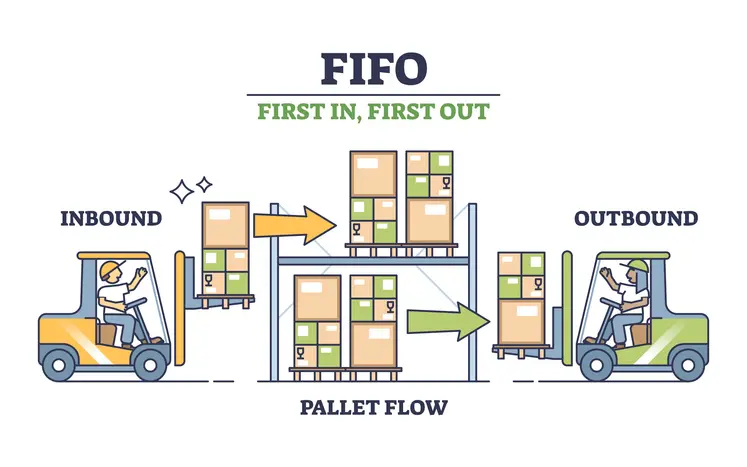

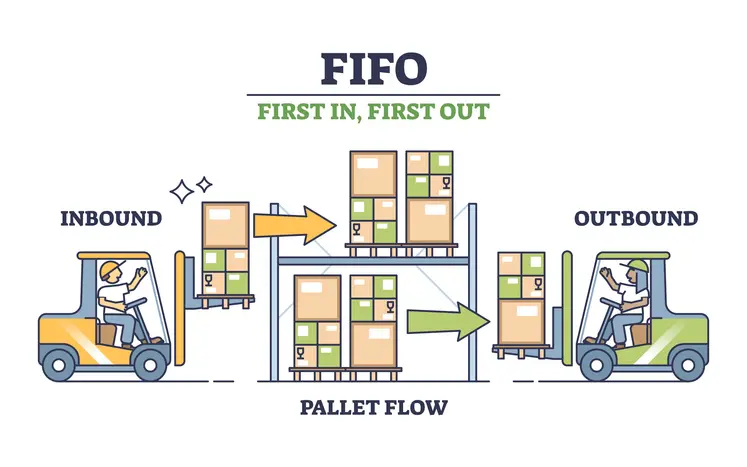

The First In, First Out (FIFO) method is a widely used inventory valuation technique that plays a crucial role in efficient inventory management. FIFO is predicated on the principle that the first items purchased or produced are the first to be sold or used. This method aligns closely with the natural flow of inventory, making it a logical choice for many businesses. Implementing FIFO can significantly impact financial statements, tax liabilities, and overall profitability. This article delves into the intricacies of the FIFO method, providing a comprehensive guide on what it is, how it works, and its advantages and disadvantages.

Inventory management is a critical aspect of any business that handles physical products. Effective inventory management ensures that a company can meet customer demand without overstocking, which can tie up capital and increase holding costs. There are several methods to value inventory, each with its advantages and implications. The FIFO method, one of the most commonly used, assumes that the oldest inventory items are sold first. In a business context, inventory valuation methods can significantly influence financial performance. FIFO stands out among these methods because it often aligns with the actual physical flow of goods, especially in industries where products have a limited shelf life or where older stock needs to be sold first to maintain quality and reduce waste. Understanding FIFO and its implementation is essential for accurate financial reporting and efficient inventory management.

The FIFO method is based on a straightforward principle: the first items added to inventory are the first ones to leave. This principle is particularly beneficial for businesses where inventory items are perishable or subject to obsolescence. If the FIFO method is the one that interests you and your business needs, here is a step-by-step guide on how to implement FIFO in inventory management:

Track Inventory Chronologically: Maintain detailed records of inventory purchases, including the date of acquisition and the cost of each batch.

Identify the Cost of Goods Sold (COGS): When a sale is made, the cost of the oldest inventory items is assigned to COGS. This ensures that the earliest acquired items are considered sold first.

Update Inventory Records: After each sale, update the inventory records to reflect the reduction in stock from the oldest batch. Continue this process, ensuring that the oldest inventory is always the first to be accounted for in sales.

Financial Reporting: Use the FIFO method to prepare financial statements, ensuring that the cost of goods sold reflects the costs associated with the earliest inventory items. This often results in higher ending inventory values during periods of inflation.

To better illustrate the FIFO method, let us consider the following example:

Suppose a company, ABC Corp., has the following inventory purchases:

January 1: 100 units at $10 each

February 1: 150 units at $12 each

March 1: 200 units at $15 each

ABC Corp. sells 300 units on March 15. Using the FIFO method, the calculation for the cost of goods sold (COGS) would be:

First, 100 units from January 1 at $10 each = $1,000

Next, 150 units from February 1 at $12 each = $1,800

Finally, 50 units from March 1 at $15 each = $750

Thus, the total COGS is

$1,000 + $1,800 + $750 = $3,550

In comparison, if another method such as Last In, First Out (LIFO) were used, the COGS calculation would differ significantly, potentially impacting the financial outcomes such as net income and tax liabilities.

The FIFO method offers several significant advantages that make it a popular choice among businesses for inventory valuation. These advantages stem from how FIFO aligns with actual inventory flow, influences financial statements, and impacts operational efficiency. Understanding these benefits can help businesses make informed decisions about inventory management and financial planning. Below, we explore the key advantages of implementing the FIFO method in detail.

One of the primary advantages of FIFO is that it often results in a higher valuation for ending inventory. This occurs because, under FIFO, the remaining inventory comprises the most recently purchased items, which are likely to have higher costs due to inflation. As a result, the inventory on hand at the end of the period reflects more current market prices, leading to a higher asset valuation on the balance sheet.

FIFO can lead to higher net income, especially in times of rising prices. Since the older, less expensive items are accounted for in the cost of goods sold, the remaining inventory, which is more expensive, stays on the balance sheet. This results in lower COGS and higher gross profit. Higher gross profit translates into higher net income, which can be beneficial for companies looking to attract investors or secure financing.

FIFO is often aligned with the actual physical flow of inventory, particularly in industries where products have a shelf life, such as food and beverage, pharmaceuticals, and certain consumer goods. This alignment ensures that older stock is sold first, reducing the risk of obsolescence and spoilage. It also simplifies inventory management, as the financial records mirror the physical movement of goods.

The financial benefits of using FIFO extend beyond higher net income. A higher ending inventory value can improve key financial ratios, such as the current ratio and inventory turnover ratio, making the company appear more financially healthy. Additionally, during inflationary periods, FIFO can result in better matching of current sales revenue with historical costs, providing a more accurate reflection of profitability.

Implementing FIFO can enhance cash flow management. By aligning inventory costs with current market conditions, companies can better predict cash flow needs and plan for future expenses. Higher net income also means higher retained earnings, which can be reinvested into the business or used to pay down debt, further improving cash flow.

FIFO can lead to an improved inventory turnover rate, as it encourages the movement of older stock first. This reduces the likelihood of inventory sitting idle, tying up capital, and incurring holding costs. A higher turnover rate is often viewed positively by investors and creditors, as it indicates efficient inventory management and a higher rate of sales.

While the FIFO method has numerous advantages, it is not without its drawbacks. These disadvantages can affect financial reporting, tax liabilities, and suitability for certain industries. Understanding the potential downsides of FIFO is crucial for businesses to make informed decisions about their inventory valuation methods. Below, we delve into the key disadvantages of the FIFO method, highlighting scenarios where it might pose challenges or be less advantageous.

While FIFO has many advantages, it can also lead to discrepancies in financial reporting if the cost of goods sold (COGS) spikes suddenly. For example, during periods of rapid inflation or supply chain disruptions, the cost of new inventory may increase significantly. Since FIFO assigns the oldest costs to COGS, the reported costs may not reflect the current market conditions, potentially distorting profitability and financial ratios.

Another potential downside of FIFO is the higher tax liabilities it can incur. Because FIFO often results in higher net income, it also leads to higher taxable income. Companies may face increased tax expenses, which can impact cash flow and overall financial health. This is particularly relevant in jurisdictions with high corporate tax rates.

In addition to immediate tax implications, using FIFO can lead to higher long-term tax liabilities. As older, cheaper inventory is sold off, the remaining inventory costs increase, resulting in a higher tax burden over time. Companies need to carefully consider these tax implications and plan accordingly.

During periods of inflation, FIFO can affect financial statements in several ways. The cost of goods sold may appear artificially low, while the ending inventory value is higher. This can create a mismatch between revenues and expenses, making it challenging to assess true profitability. Investors and analysts must be aware of these nuances when interpreting financial statements prepared using FIFO.

While FIFO is suitable for many industries, it may not be ideal for all. Industries with highly volatile inventory costs or where the latest inventory costs are crucial for pricing strategies may find FIFO less useful. Additionally, sectors that rely heavily on just-in-time inventory systems might struggle to implement FIFO effectively.

Choosing the right inventory valuation method is critical for accurate financial reporting and efficient inventory management. While FIFO is a popular choice, it is essential to compare it with other valuation methods to understand its relative strengths and weaknesses. Each method has distinct implications for the cost of goods sold, net income, tax liabilities, and inventory management. In this section, we compare FIFO with other common inventory valuation methods to help businesses determine the best approach for their specific needs and circumstances.

The key difference between FIFO and Last In, First Out (LIFO) lies in the order in which inventory costs are assigned to COGS. LIFO assumes that the most recently acquired items are sold first, which can result in higher COGS and lower net income during inflationary periods. This, in turn, can lead to lower tax liabilities. However, LIFO is not permitted under International Financial Reporting Standards (IFRS), limiting its use to certain regions, such as the United States.

The weighted average cost method calculates COGS and ending inventory based on the average cost of all units available for sale during the period. This method smooths out price fluctuations but may not accurately reflect the actual flow of goods. FIFO, on the other hand, can provide a more precise match between the physical movement of inventory and its financial reporting.

Specific inventory tracing assigns actual costs to specific items, making it highly accurate but also more complex and time-consuming. This method is ideal for businesses with unique or high-value items. FIFO is simpler to implement and manage, making it a practical choice for companies with large volumes of inventory.

The moving average costing method continually updates the average cost of inventory after each purchase. This method provides a dynamic and current valuation but can be complex to manage. FIFO offers a more straightforward approach, particularly useful for businesses where inventory items are consistently moving.

The FIFO method has specific implications for accounting practices, influencing how inventory costs are recorded and reported. Accurate accounting using FIFO ensures that financial statements reflect the actual cost flow of inventory, providing a true representation of a company’s financial health. This section explores the intricacies of recording FIFO in accounting books, its impact on the cost of goods sold (COGS), and how it aligns with financial reporting standards such as IFRS and GAAP. Understanding these aspects is crucial for maintaining compliance and achieving precise financial reporting. Recording FIFO in accounting books involves tracking inventory purchases and sales chronologically. Each time inventory is purchased, the cost is recorded and added to the inventory account. When inventory is sold, the oldest costs are assigned to COGS. This requires meticulous record-keeping to ensure that the oldest costs are used first. The impact of FIFO on COGS is also significant. By assigning the oldest costs to COGS, FIFO typically results in lower COGS during periods of rising prices. This can increase gross profit and net income. However, during periods of declining prices, FIFO may result in higher COGS and lower profitability. FIFO is accepted under both International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP). This makes it a versatile and widely applicable method. However, companies must ensure that their implementation of FIFO complies with the specific requirements and disclosures mandated by these standards.

The FIFO method’s applicability and benefits can vary significantly across different industries. Each sector has unique inventory characteristics and requirements that influence how FIFO is implemented and its effectiveness. By examining specific examples of FIFO in various industries, we can better understand its practical applications and advantages. This section explores how FIFO is utilized in the retail, manufacturing, and food and beverage industries, providing insights into its role in improving inventory management, reducing waste, and enhancing financial performance.

In the retail industry, FIFO is commonly used to manage inventory turnover and reduce the risk of obsolescence. Retailers often deal with products that have a limited shelf life or are subject to seasonal trends. By using FIFO, retailers can ensure that older stock is sold first, maintaining product freshness and minimizing waste.

Manufacturers benefit from FIFO by maintaining a consistent flow of raw materials and finished goods. This method helps in managing production schedules and reducing the risk of stockouts or excess inventory. FIFO is particularly useful in industries where materials have a limited shelf life or where production processes rely on a steady supply of inputs.

The food and beverage industry relies heavily on FIFO to ensure product safety and quality. Given the perishable nature of many products, FIFO helps in minimizing spoilage and waste. This method also aids in compliance with food safety regulations and maintaining customer satisfaction by ensuring that the freshest products are available for sale.

If all you have read thus far has piqued your interest, let us assess the many ways in which the FIFO method can be implemented in your business, the way that your business needs. Adopting the FIFO method can streamline inventory management and enhance financial accuracy, but successful implementation requires careful planning and execution. Businesses must consider various factors, from selecting the right software solutions to training employees and maintaining accurate records. This section provides a detailed guide on best practices for implementing FIFO, common mistakes to avoid, and how to leverage technology to facilitate the process. By following these guidelines, businesses can ensure a smooth transition to FIFO and reap the benefits of this efficient inventory valuation method. Implementing FIFO can be streamlined with the use of specialized inventory management software. These solutions automate the tracking of inventory purchases and sales, ensuring accurate and efficient implementation of FIFO. Features to look for include real-time inventory tracking, automated cost calculations, and integration with accounting systems.

There are also some best practices to consider when adopting the FIFO method. Conducting regular inventory audits is vital, and involves conducting periodic audits to ensure the accuracy of inventory records. With clear labeling and organization, the identification of older stock is facilitated – which is necessary for the First In, First Out strategy. Building on this point, it is of utmost importance that businesses maintain detailed and up-to-date records of inventory purchases and sales. Next, we have top-tier employee training. It is crucial that employees are trained regarding the importance of FIFO and how to implement it in daily operations.

Along with the best practices, come a series of common mistakes we caution you to avoid. Firstly, ignoring stock rotation can result in older inventory being overlooked. The stock should be frequently rotated. Next, inaccurate record-keeping can lead to errors in COGS calculations. It is of utmost importance that record keeping is consistent and correct. And lastly, overlooking software capabilities can hinder FIFO implementation. Businesses should fully utilize the features of inventory management software.

Choosing the appropriate inventory valuation method is a crucial decision for businesses, as it directly impacts financial reporting, tax liabilities, and operational efficiency. While FIFO is a widely used method, it may not always be the best fit for every situation. Factors such as market conditions, industry practices, and long-term financial goals should inform the decision-making process. In this section, we examine the considerations for selecting between FIFO and other valuation methods, provide guidance on analyzing situational factors, and offer industry-specific recommendations. By evaluating these factors carefully, businesses can determine the most suitable inventory valuation method to optimize their financial performance.

The choice between FIFO and LIFO depends on various factors, including market conditions, tax implications, and industry practices. FIFO is generally preferable in environments with stable or rising prices and where maintaining accurate inventory flow is critical. LIFO might be beneficial in reducing tax liabilities during periods of inflation, but it is restricted by IFRS regulations. It is also advised to consider the long-term financial implications of each method. FIFO typically results in higher net income and asset valuation, which can enhance a company’s financial position and attract investors. However, the associated higher tax liabilities must be factored into long-term planning. Furthermore, different industries may have specific requirements that influence the choice of inventory valuation method. For instance, FIFO is often recommended for industries dealing with perishable goods or where inventory turnover is high. In contrast, industries with stable or declining prices might benefit from alternative methods like weighted average costs.

This article has provided an in-depth exploration of the FIFO method, covering its principles, implementation steps, advantages, and disadvantages. Key takeaways include the method’s alignment with actual inventory flow, its financial benefits, and the potential for higher tax liabilities. Choosing the right inventory valuation method is crucial for accurate financial reporting and efficient inventory management. While FIFO offers numerous advantages, it is essential to consider the specific needs and circumstances of your business. By carefully evaluating the benefits and drawbacks, companies can make informed decisions that support their financial health and operational efficiency.